sales tax calculator austin texas

Texas Sales Tax Filing Address. Combined with the state sales tax the highest sales tax rate in Minnesota is 8875 in.

Texas Used Car Sales Tax And Fees

In sum that means sales tax rates in North Carolina range from 675 to 750.

. 2020 rates included for use while preparing your income tax deduction. Brownsville TX Sales Tax Rate. Texas Comptroller of Public Accounts 111 E.

Your household income location filing status and number of personal exemptions. VesselBoat Application PWD 143. Arlington TX Sales Tax Rate.

Comptroller of Public Accounts PO Box 149354 Austin TX 78714-9354Taxpayers may also file Texas sales tax returns by completing and mailing Form 01-114. For refund information related to Franchise Tax please call 800-531-5441 ext. Rates include state county and city taxes.

Minnesota has state sales tax of 6875 and allows local governments to collect a local option sales tax of up to 15There are a total of 273 local tax jurisdictions across the state collecting an average local tax of 0521. Below are the sales tax rates for all the counties in North Carolina. 17th Street Austin TX 78774-0100.

Use our sales tax calculator or download a free Texas sales tax rate table by zip code. Sales Tax Calculator. For example in one of the eight counties with a 15 percent surtax there would be a total of 75 percent sales tax charged 6 percent plus 15 percent.

In Durham and Orange counties specifically there is an additional 05 tax which is used to fund the Research Triangle Regional Public Transportation Authority. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on mixed beverages.

Tax paid previously in Texas or in another state on this vessel andor outboard motor. Please note that if you file your Texas. The State of Texas assesses a 5 prize fee on bingo winnings in excess of 5.

Fish and Wildlife Service Office for Diversity and Workforce Management 5275. Box 149348 Austin TX 78774-9348. Comptroller of Public Accounts PO Box 149354 Austin TX 78714-9354.

Beaumont TX Sales Tax Rate. Send franchise tax amended reports to. Click here for a larger sales tax map or here for a sales tax table.

The tax rate is 625 of the sales price. Tax is assessed at the time of registrationtitle transfer and is due within 45 working days from the date of sale or date brought to Texas. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Use this calculator with the following forms. The City receives 107143 of total mixed beverage tax receipts collected in Austin. The latest sales tax rates for cities in Texas TX state.

Austin TX Sales Tax Rate. Sales and Use Tax Return to the following address. Texas Comptroller of Public Accounts PO.

Austin TX 78744 or the US. BoatMotor Sales Use and New Resident Tax Calculator. Applications filed later than 45 working days are subject to tax penalties and interest.

You will have to add the surtax amount to the basic sales tax rate to find the final sales tax rate. Up to date 2022 Texas sales tax rates.

5 Things To Know About Commercial Property Tax Rates In Austin Texas Protax

Sales Tax On Grocery Items Taxjar

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Harris County Tx Property Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

Llc Tax Calculator Definitive Small Business Tax Estimator

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

How To Add Social Sharing Buttons To Your Squarespace Blog Posts Squarespace Web Design By Christy Price Social Share Buttons Squarespace Blog Squarespace

Property Tax How To Calculate Local Considerations

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

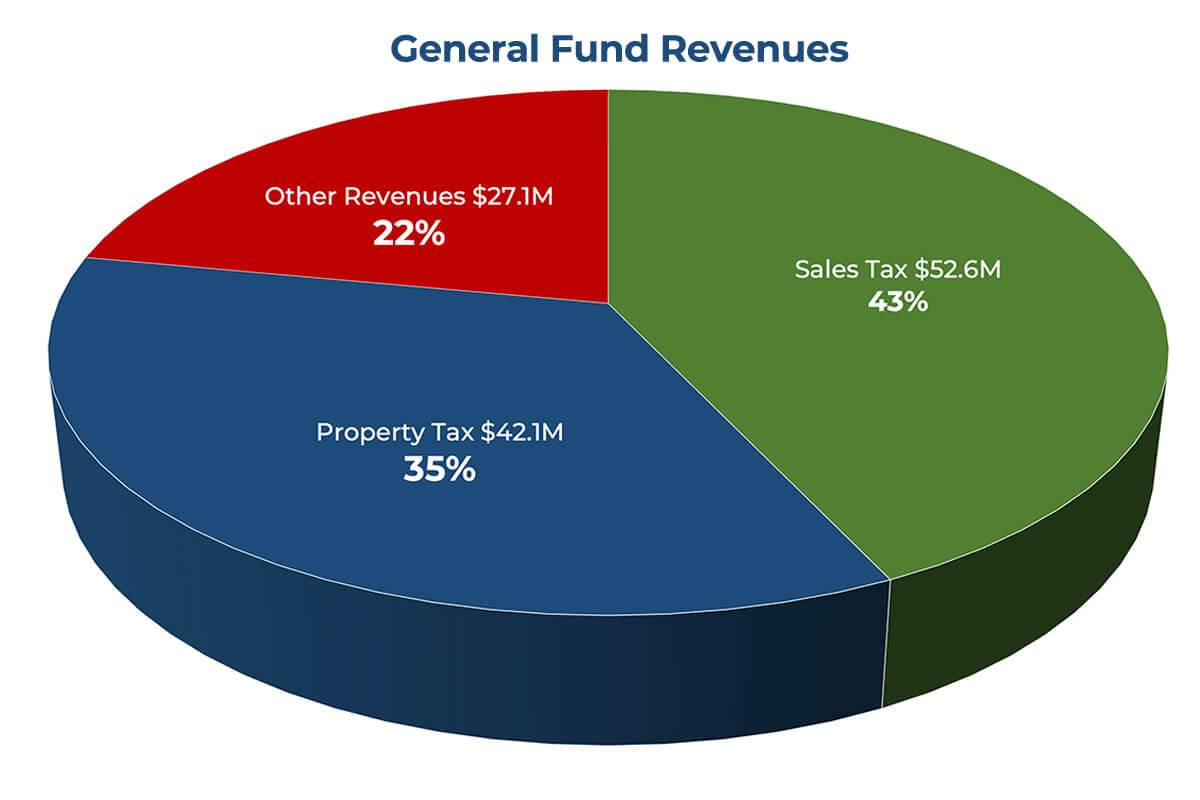

Blog How We Pay For Basic City Services May Surprise You City Of Round Rock

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

The New Insurance Plan Comparison Tool Has Been Released Investing Filing Taxes Tax Lawyer

Illinois Sales Tax Guide For Businesses

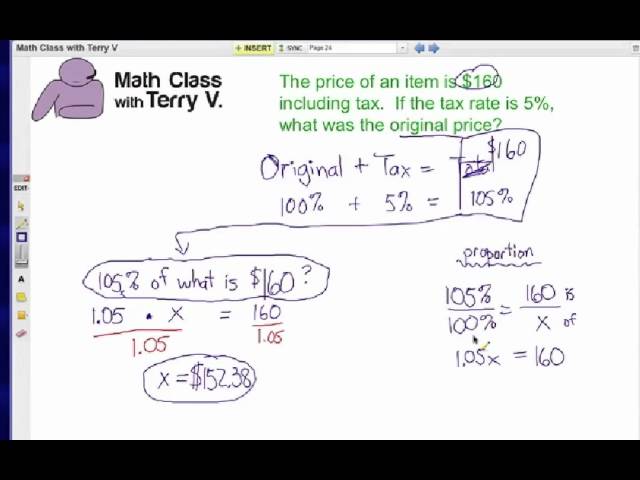

How To Find Original Price Tax 1 Youtube